Risk Management

The Company considers effective risk management and mitigation to be integral to our business operations. We encourage employees to have a positive attitude to risk and to understand the risks that are inherent in our business. As well as having the right tools and processes, effective risk taking requires the right culture and behaviours across our businesses.

Our risk management culture and processes meet world-class standards.

-

The company was recognized and listed on the Dow Jones Sustainability Indices (DJSI) for the 10th consecutive year in 2023, for risk and crisis management received a score in the 99th percentile. Additionally, the company was awarded the “Environmental & Social Management (ESRM) Pioneer Award” hosted by ERMA (Enterprise Risk Management Academy).

Risk management structure, roles and responsibilities are clearly established. The Board of Director (BoD) provides important oversight to enterprise risk management and is aware of and concurs with the Company’s risk appetite level. The BoD appointed the Risk Management Committee (RMC) to oversee risk management implementation and regularly reports risks and mitigations. The RMC is diverse, composed of independent directors and top executives, while the chairman of the RMC is an independent director

RISK MANAGEMENT CULTURE

The Company continues to embed risk culture through all levels of the business. Starting from the Companys Board of Directors (BoD), Risk Management Committee (RMC) and leaders promote and enforce consistent and effective risk management, making it part of our organizational culture. The policy, framework, guidelines and structure of risk management demonstrate formal communication.

BoD including executive and non-executive directors, RMC and leaders monitor, assess and are trained regularly on Group-wide Risk Management, key risks and emerging risks.

Training on risk management principles is provided throughout the organization, including sessions on the Newly Updated Group Risk Management Manual and Framework, which introduces 7 New Perspectives for Impact Assessment Criteria. These sessions focus on TU’s Enterprise Risk Management (ERM) objectives and processes, ensuring a comprehensive understanding of risk management. Additionally, training on "Slowing Growth, Growing Risk – Where Next for the Global Economy" addresses global economic conditions in relation to sustainability and ESG, encouraging participants to consider associated risks and opportunities. To further promote risk awareness, we offer suggestions in quarterly Risk Management Committee (RMC) meetings, oversee group-wide and entity-level risk management processes, and conduct regular training programs for director and management. Our commitment extends to advising on evaluating risk management effectiveness within Thai Union Group PCL and its subsidiaries.

Employees are encouraged to have a positive attitude towards proper risk management from their first day with Thai Union. This is consistently reinforced throughout their time with the organization, such as through the new joiner program, risk management training, ongoing activities and internal news updates.

Financial incentives incorporating risk management metrics are linked to the achievement of mitigation plan, which are aligned with our enterprise objectives and cascaded to various areas of the company, including business units and corporate functions. These mitigation plan cover financial, strategic, compliance, and operational risks, such as health and safety, product innovation, labor practices, and climate change. The mitigation plan are converted into targets/KPIs for senior executives and line managers, directly influencing their incentives. The company’s performance in achieving enterprise objectives, along with individual performance, determines the rate of remunerated bonus payments, reinforcing our commitment to effective risk management across the organization.

In addition, risk management is embedded in business planning, decision and execution. Examples of key areas include:

- Incorporating risk criteria into our product development and approval process is a critical aspect of our strategy. Innovation is considered an integral part of enterprise risk, with Key Risk Indicators (KRIs) such as project net sales, project GP margin, and %NSV of innovation projects used for each product innovation launched. At our Global Innovation Center (GIC), risk criteria are analyzed throughout the stage gate process, from concept development to product commercialization. The risk assessment results are then presented to the RMC for review before proceeding with further product development activities. Additionally, risk criteria on innovation investment and returns are reviewed and discussed during RMC meetings with board members for further approvals (if any).

- Strategic risks are considered in the strategy planning process and during the implementation of initiatives complying with the decided strategy.

- New strategic investments, including M&A, new types of business investment, and large capital expenditure are embedded in risk management. The risk profile will be reviewed by the Risk Management Committee (RMC) for suggestions on the adequacy and appropriateness of the risk response.

- Financial strategy and risks were taken care of closely and driven by Group Treasury and the Finance Shared

Services function and comply with Group Financial Risk Management and Treasury Policy.

The framework parameters and the acceptable risks are approved by the BoD and used as the key communication and control tools for the management and treasury team,globally. - Sustainable strategy and risk management were taken care of closely and driven by the Sustainable Development Committee lead by the President and CEO as the Chairman of the Committee.

- IT security strategy and risk management were taken care of closely and driven by the IT Security Committee lead by the President and CEO as the Chairman of the Committee.

See more

Risk Management Framework

The Company’s risk management framework is in accordance with the international standards of COSO ERM and ISO 31000 : 2018 (Risk Management Principles and Guidelines). It is a guideline for management and employees to operate consistently. The framework is designed to identify, assess, manage, monitor and communicate systematically and consistently in order to minimize the probability of risks occurring and limit their potential impact on Company business. Thai Union Group processes risk management at a Group level, business segment level, and entity level. Hence, the quarterly risk exposure review is conducted with entity risk coordinator, risk owner and Risk Management Committee (RMC). In the meantime, RMC quarterly reports significant risks, mitigations, and improvements to the Board of Director.

RISK MANAGEMENT PROCESS

The company’s risk management process comprises the following 7 steps:

Understanding business context, vision, mission, core values and setting aligned short-term and long-term objectives for Thai Union Group, product groups, and business units.

Identifying all risks or events that may occur and potentially impact the achievement of set goals. These uncertainties can be either positive events (opportunities) or negative events (risks) that might arise. Thai Union Group considers identifying risk factors from three perspectives as follows:

- The possibility that strategy and business objectives may not align with the mission, vision, and core values.

- Evaluating the Chosen Strategy.

- Risk to implementing the Strategy and Business Objectives.

Under Thai Union Group's risk management policy framework, identifying risk factors will be comprehensive in all dimensions, including financial and non-financial aspects, environmental, social, and governance (ESG) aspects, as well as emerging risks, classified by risk groups such as

- Strategic Risk: The risk that arises from inappropriate and unsuccessful strategic, business planning, governance and resource allocation, including undesirable changes in external environments such as economics, social, political and hazard.

- Operational Risk: The risk that associates with company operations starting from planning, sourcing, production, selling including information system to support operations.

- Financial Risk: The risk that associates with financial reporting, financial obligation and financial management, including investment.

- Compliance Risk: The risk that associates with meeting the requirements of laws, regulations, practices, standards, and internal policies and procedures.

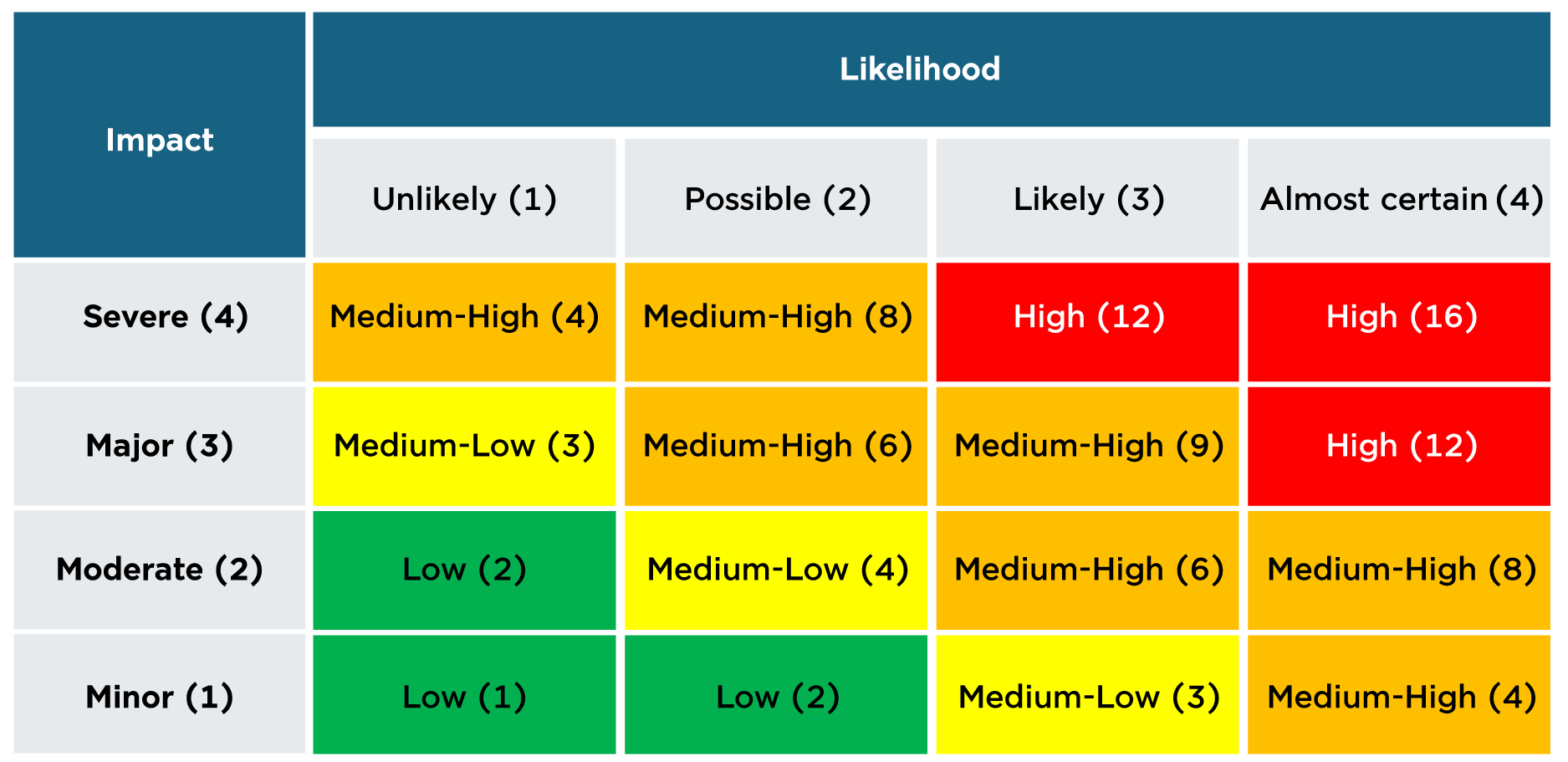

Thai Union Group conducts risk assessment and analysis in all dimensions of sub-risks according to the Risk Criteria in the main dimensions, which include financial, business process and operations, corporate reputation, customer, and personnel. These are the standard criteria used throughout the organization for considering Group-wide level risk and Business Unit (BU) level risk. The organization's standard risk assessment criteria are as follows:

- Impact Assessment Criteria

The criteria for assessing the impact of risks include seven perspectives: Net Profit, Corporate or Brand Reputation, Health & Safety, Business Interruption, Laws & Regulations or Non-compliance, Environmental & Social, and Information Technology. This is divided into 4 levels, ranging from: Minor, Moderate, Major, Severe. - Likelihood Assessment Criteria

The criteria for assessing the likelihood of risks include two perspectives: Probability and Frequency. This is divided into 4 levels, ranging from: Almost certain, Likely, Possible, Unlikely.

Risk level represents the relationship of two perspectives, impact and likelihood of a risk event, which can be defined into 4 risk levels, as shown in the following table.

After conducting the residual risk assessment, the management shall consider the residual risk has been reduced to be within the risk appetite risk level.

The risk response strategies can be categorized into five types: Avoid, Reduce, Transfer, Accept, and Enhance.

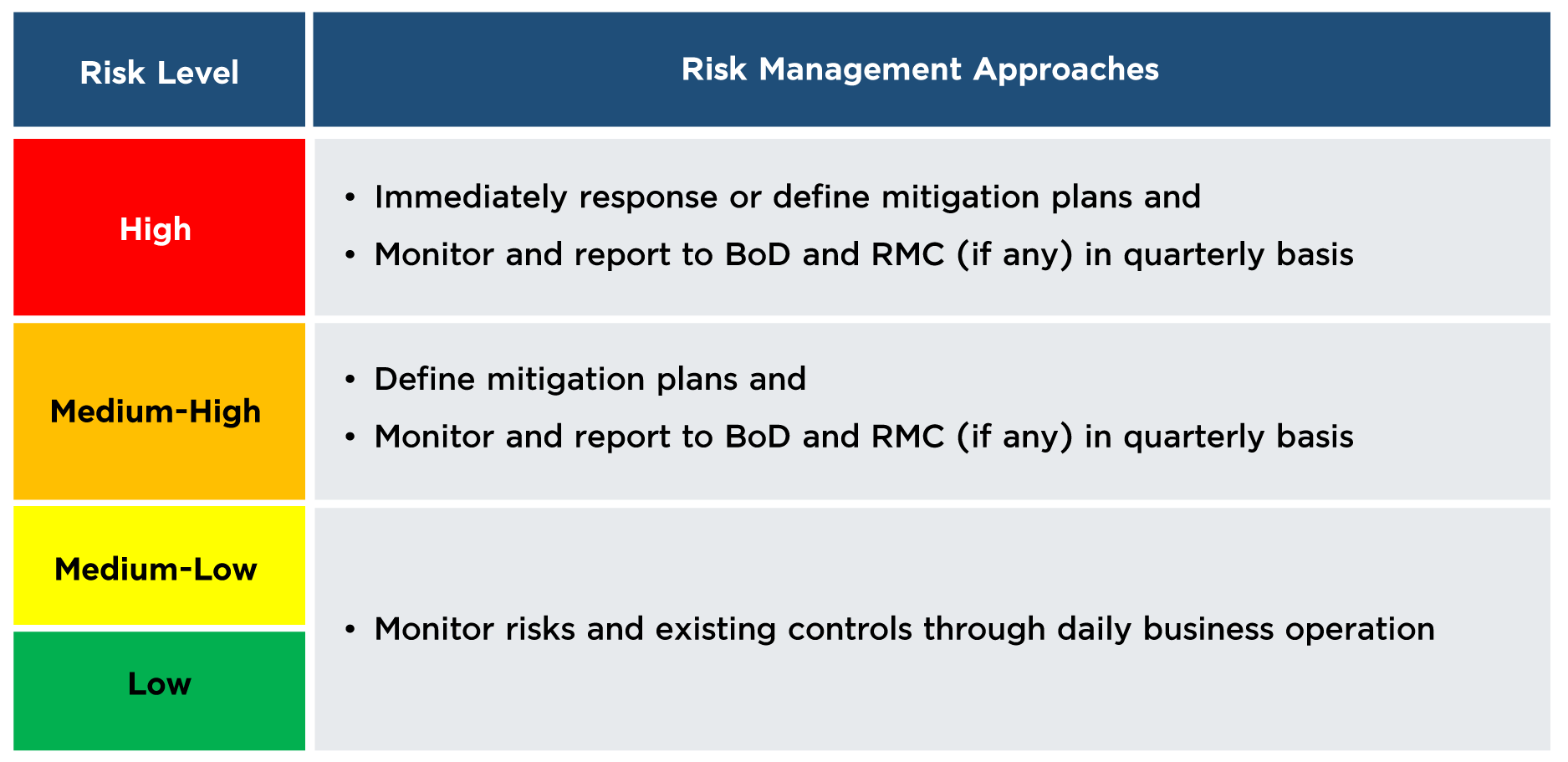

The risk management approaches for each risk level are presented in the following table.

Under Thai Union Group’s risk management policy, the charter of the Risk Management Committee, Thai Union Group continuously monitors, reviews, assesses, and reports on risk management. This ensures that all risk items can promptly respond to current and future situations, events, and operational conditions. The following actions are taken:

- The Risk Management Committee (RMC) continuously monitor and develop the risk management framework and risk management process of the Company and its subsidiaries, aligned with international guidelines, and oversee the continuous activities of assessment, analysis and review of the Company and its subsidiaries’ significant risks, under normal and crisis conditions. The significant risks and mitigation is regularly communicated to the Board of Directors.

- Thai Union Group requires that at least one person at each subsidiary must be assigned as Risk Coordinator with clearly set roles and responsibilities as a guideline for effective and efficient implementation of risk management.

- Risk Coordinators of subsidiaries and Thai Union’s Group Risk Management Department collaborate and coordinate regularly. The Group Risk Management Department is required to share reporting form to the risk coordinators to be used for gathering all required information and submitting the information to the Group Risk Management Department within the specified time frame. The Group Risk Management Department will then use the information to develop the key corporate risk profiles

Relevant information shall be identified, stored, and communicated in an appropriate format and within a timeframe that allows personnel to adopt it according to their responsibilities. Information is required by personnel at all levels for identifying, evaluating, and responding to the risks. Communication must be effective and widely recognized, spanning from top to bottom, between departments, and bottom-up interactions. Personnel from all departments shall receive clear information about their roles and responsibilities.

To ensure the effectiveness of the overall risk management, which is crucial for supporting the success of an organization's mission and business objectives, Thai Union Group emphasizes auditing the system's operations according to international standards. The audit includes:

- Internal Audit

Thai Union Group’s Internal Audit (IA), responsible for examining Thai Union Group 's risk management and internal control systems to ensure adequacy and effectiveness and report the result to Audit Committee which comprises of only independent directors at least once a year. - External Audit

Conducted by external auditors to certify compliance with international standards and best practices annually. Examples include certifications for ISO 9001 on Quality Management System by the UKAS management system, ISO 14001 on Environmental Management System by the UKAS management system, Independent Assurance Statement relating to Thai Union Group’s Sustainability report by LRQA (Thailand) Limited, The audit of consolidated financial statements and the separate financial statements by KPMG Phoomchai Audit Ltd.

Risk Appetite Statement

Risk appetite is an important factor to consider when Thai Union Group sets strategies and determines the direction of risk management. High and Medium-High are considered to exceed the risk appetite and require the immediate actions or mitigation plans. Below are the examples of Thai Union Group’s risk appetite:

Health & Safety:

- We are not willing to accept any permanent disability or death from work-related injuries. We will ensure the safety of everyone at our sites around the world.

Business Interruption (Plant):

- We are not willing to accept any incidents causing unplanned plant shutdowns and impact daily plant capacity. We will strive to reduce likelihood and impact of the incidents impact more than 1 day

Anti-Bribery and Corruption:

- We have zero-tolerance towards bribery and corruption and comply with the anti-bribery and corruption laws everywhere it does business.

Current and Emerging Risks

Thai Union Group is a global seafood processing company and its operating and financial results are subject to a variety of risks inherent in the seafood industry. The Company can prepare for many of the risks to mitigate any impact and/or minimize likelihood, however many of them are not within our control and could materially impact the Company’s operations, financial position or reputation.

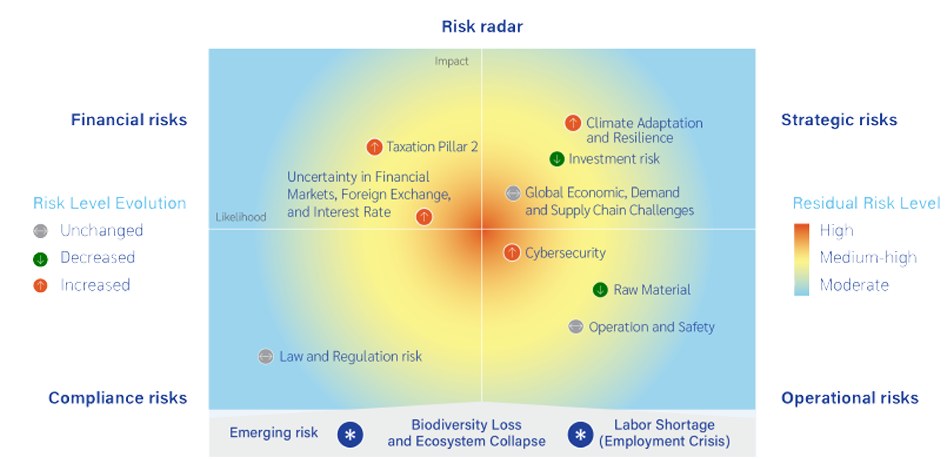

The above risk radar provides an overview of key business risk factors and emerging risks to Thai Union Group at the end of 2024 and risk level evolution compared to 2023. To ensure the emerging risk is within the company radar, Thai Union Group conducts the annual risk assessment workshop with Global Leadership Team (GLT). The inside-out and outside-in environment from global risk survey is incorporated in the workshop assumption to illustrate long-term risks that can implead the company’s strategy and business objectives.

In addition to the risk radar, Thai Union Group aware of the most severe emerging risks on a global scale over the long-term such as climate action failure, extreme weather, biodiversity loss, employment crises, social cohesion erosion, livelihood crises, infectious diseases, human environmental damage, natural resource crises, debt crises, and geoeconomic confrontation. Those emerging risks are incorporated in the annual risk assessment workshop with GLT in order to ensure the emerging risks are assessed and captured at the early stage.

Please click here to see more details of key risk factorPlease click here to see more detail current risk

Please click here to see more details of emerging risk